MulFSA: Multi-level Financial Sentiment Analysis Framework for Bond Market

Anonymous Code

Dataset (Coming Soon)

Dataset (Coming Soon)

Video Presentation

Abstract

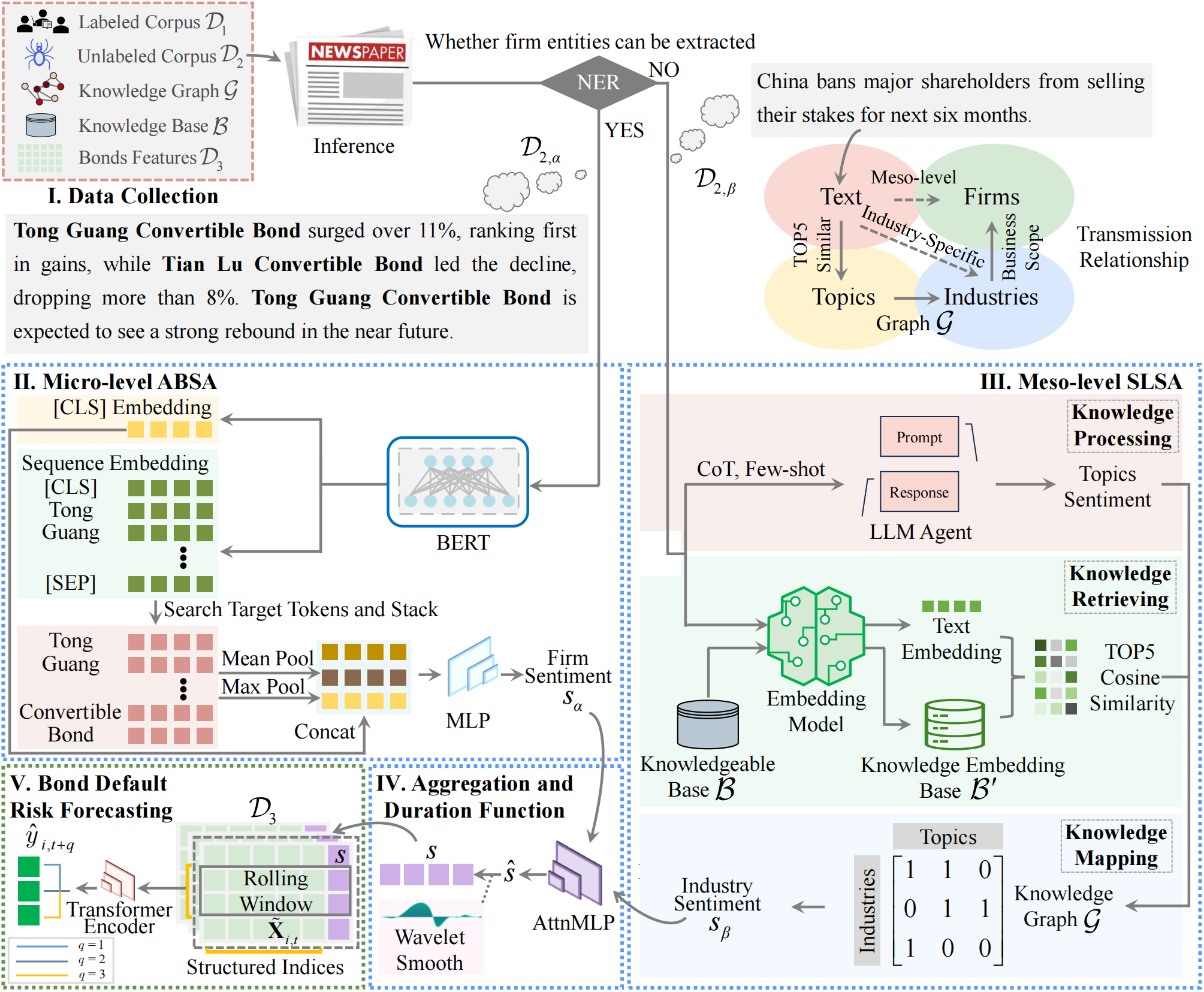

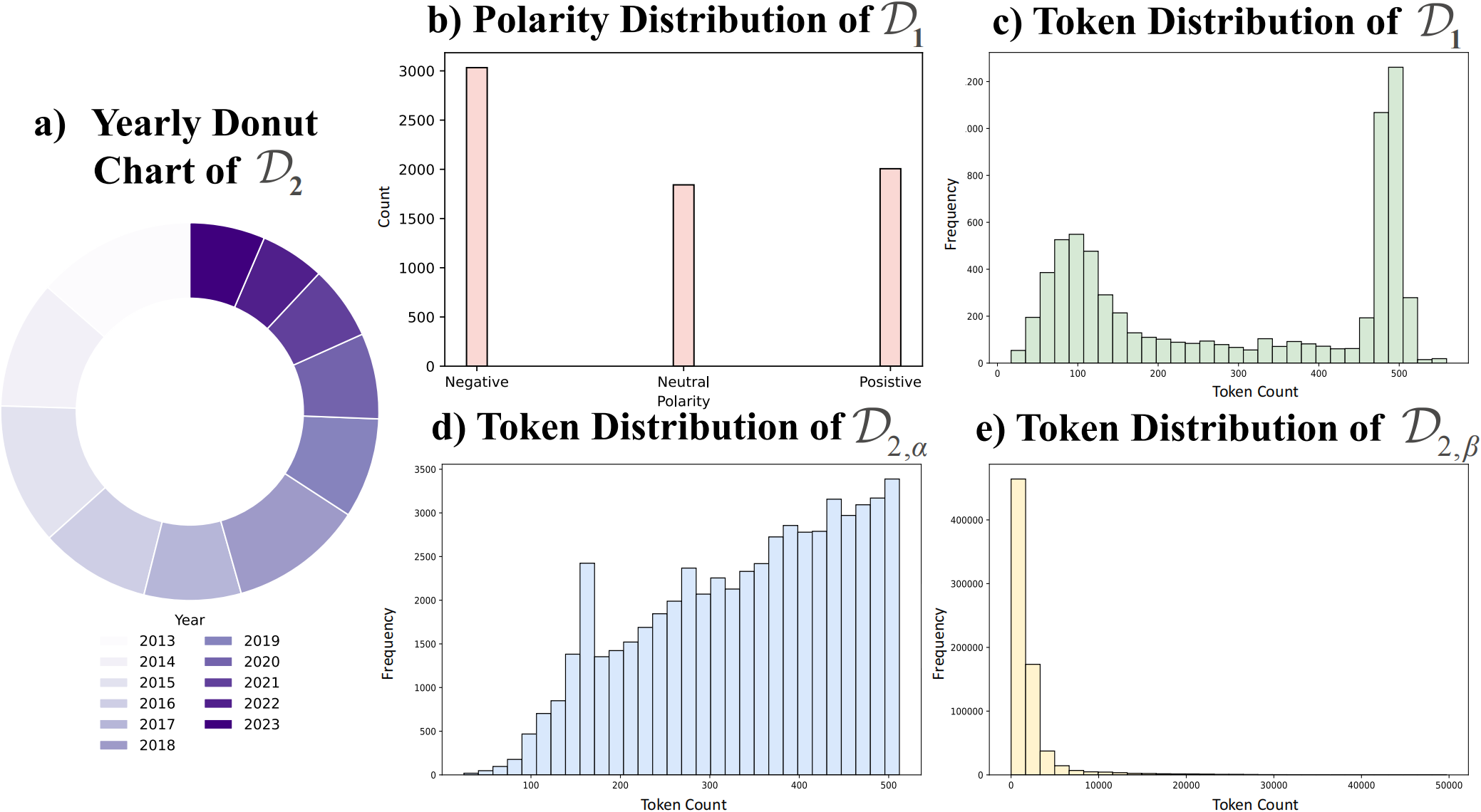

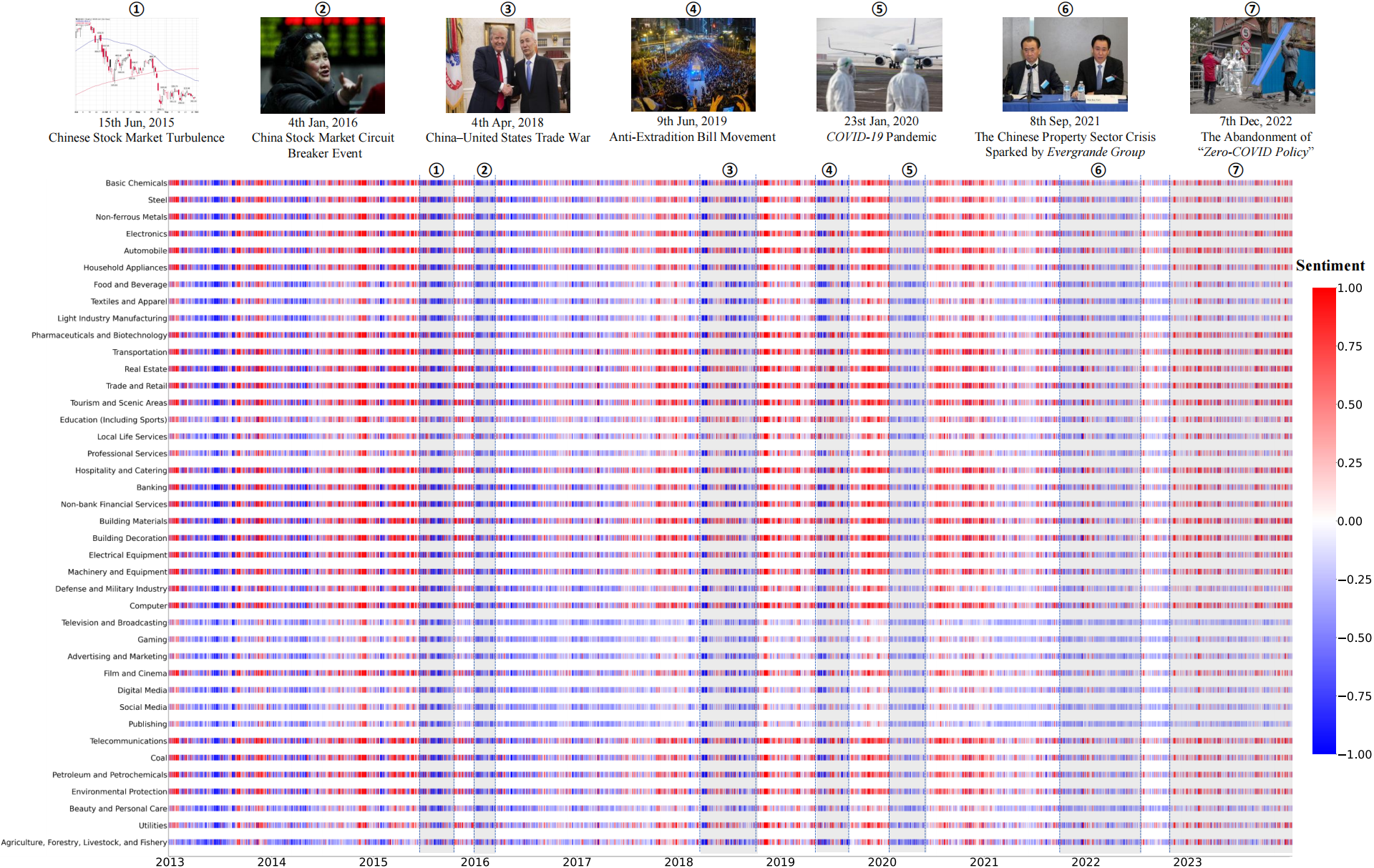

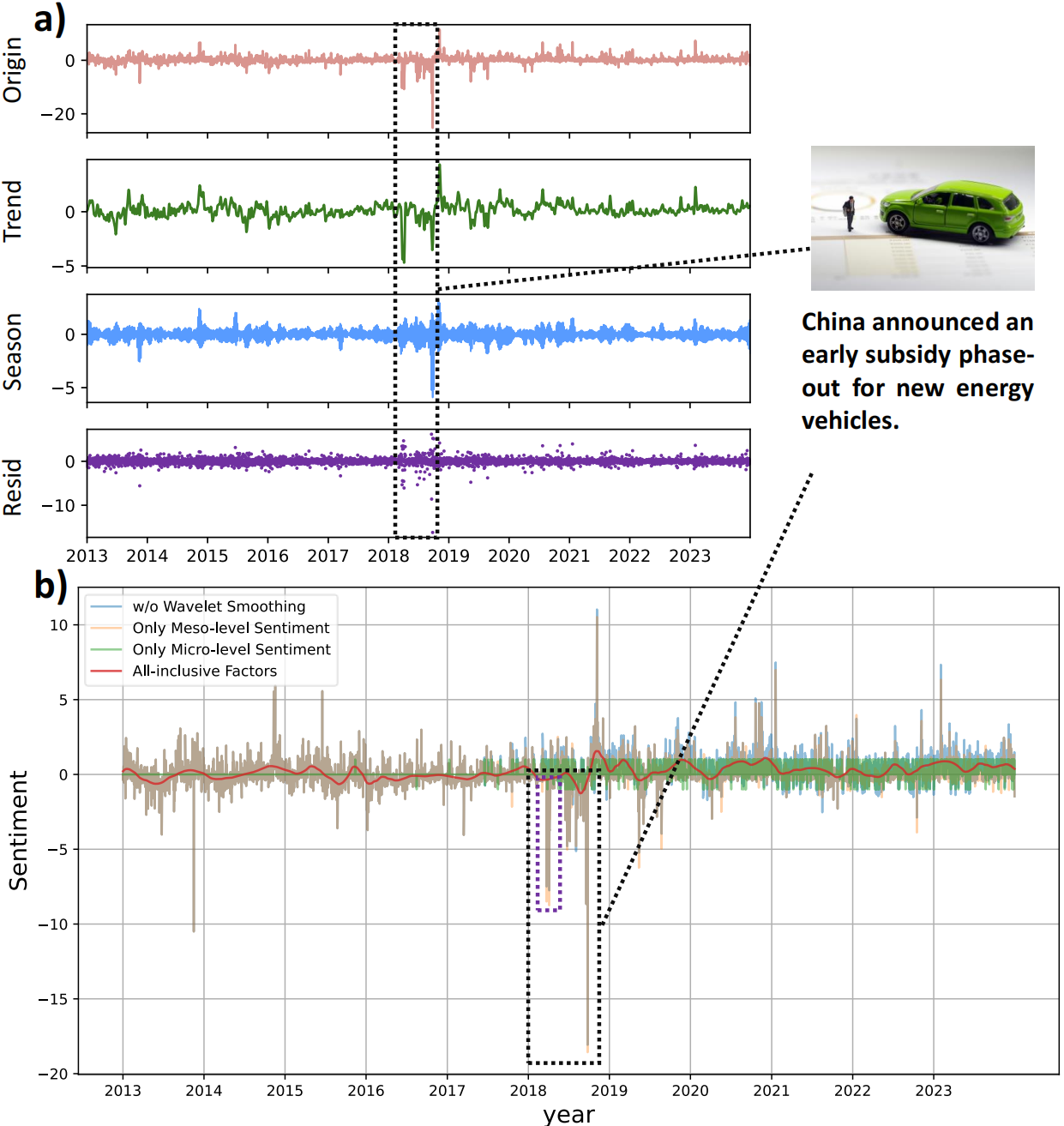

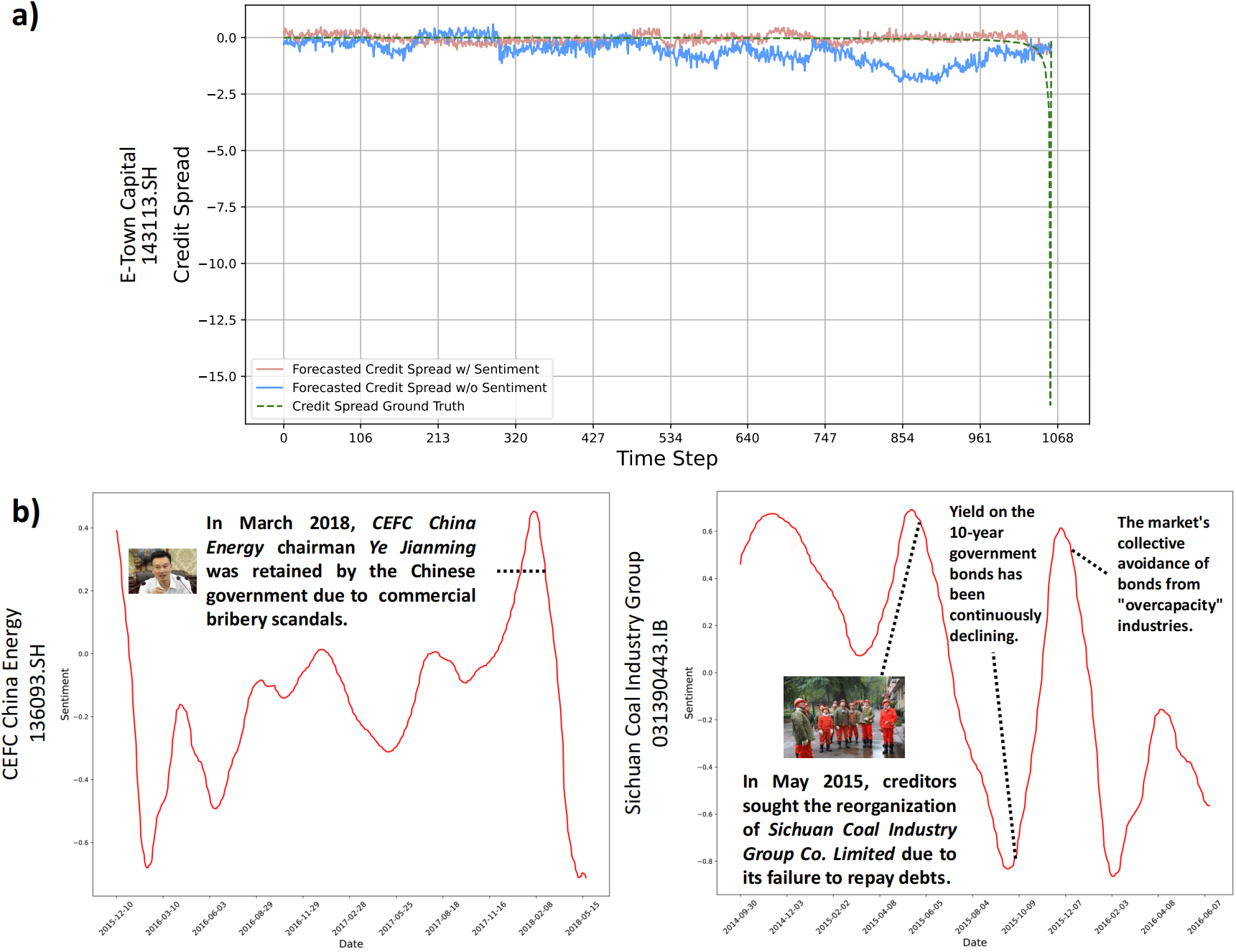

Existing financial sentiment analysis methods often fail to capture the multi-faceted nature of risk in bond markets due to their single-level approach and neglect of temporal dynamics. We propose Multi-level Financial Sentiment Analysis (MulFSA) based on pre-trained language models (PLMs) and large language models (LLMs), a novel framework that systematically integrates firm-specific micro-level sentiment, industry-specific meso-level sentiment, and duration-aware smoothing to model the latency and persistence of textual impact. Applying MulFSA to the comprehensive Chinese bond market corpus constructed by us (2013–2023, 1.39M texts), we extracted a daily composite sentiment index. Empirical results show statistically measurable improvements in credit spread forecasting when incorporating sentiment (3.25% MAE and 10.96% MAPE reduction), with sentiment shifts closely correlating with major social risk events and firm-specific crises.